How to Buy Gold ETFs

| by Michael Locklear

One of the most popular ways of adding gold to your portfolio is Gold Exchange Traded Funds. With this type of investment there is no need for you to physically store your gold. Investors can take advantage of opportunities to invest in ETFs that are physically backed and monitor the spot price of gold. There are three ETFs to choose from.

One of the most popular ways of adding gold to your portfolio is Gold Exchange Traded Funds. With this type of investment there is no need for you to physically store your gold. Investors can take advantage of opportunities to invest in ETFs that are physically backed and monitor the spot price of gold. There are three ETFs to choose from.

The largest and most popular of these gold ETF’s, which has grown enormously in response to the enormous anxiety over debt problems in the European Union and the economy of the United States, is SPDR Gold Shares(GLD) . This is where billionaires George Soros and John Paulson have their investments. The ETF with the lowest fees of only 0.25% is the iShares Comex Gold Trust(IAU)

The new kid on the block in gold ETF’s was formed in September of 2009. ETFS Gold Trust(SGOL) allows investors access to various types of gold and currently holds its stockpile in Switzerland.

What Is A Gold ETF?

Generally when buying ETFs you are purchasing shares which amount to the gold equivalent of 1/10 of an ounce. When demand from investors exceeds the shares that are available, additional purchases of physical gold are made and converted into additional stock. When the circumstances are reversed, and investors sell off their shares, then the process reverses itself. If investors wish to sell their shares and other buyers are not participating in the market than the issuer will pay the investor and liquidate a proportional amount of gold.

Market traders and investors use gold as a device to increase gold exposure or as a protection in relationship to other gold holdings. As a result there may be considerable volatility in the gold market.

There can be a generally wide variance in the expense ratios for these gold shares. Ratios may very between 0.25% and 0.50% as share value can diminish if you are holding your shares over the long term. Additionally in order to cover their operating expenses ETFs will need to liquidate some gold in order to cover their operating costs which will in turn reduce the value of each share held in the fund.

Allocated vs Unallocated Gold ETFs

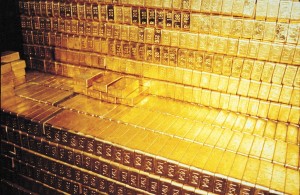

ETF gold holdings are identified into categories, allocated and unallocated. Bullion in custodial care by large banks which provide a daily list of bars being held is called allocated gold. These allocated bars undergo an audit bi-yearly by independent auditors such as Inspectorate International.

Large traders of gold futures such as J.P. Morgan or Goldman Sachs deal in unallocated gold. When trustees are required to create new sharers they may purchase futures contracts if they need to buy and deliver gold bullion quickly and there is not sufficient time to buy more. The amount of allocated gold generally exceeds holdings of unallocated goal by substantial amounts. There is a specific time frame for an ETF to make delivery of bullion into the custodial vault.

ETFS can be sold short since investors are holding sharers and not the physical precious metals. This allows for more than one investor to own the same gold. Both the investor and the bullion original owner may share the fixed commodity. Gold bars have a basket of shares allocated to them and investor may be sharing ownership. This information can be found in the prospectus of the particular ETF.

ETF’s that are physically backed generate profits that are taxed around 28% or the same as other collectibles although the investor is taxed as if he owned the precious metal in fact he only owns shares on paper. Share redemption is possible but generally quite difficult since the trade requires the participation of a broker. The transaction may be beyond the reach of your average investor since redemption requires that he made in lots in the neighborhood of 500,000 shares.

There is also a high degree of controversy around ETF’s. Investors really do not know if the gold that backs their shares actually exists. Additionally if the gold is stored in a bank that collapses many ETF assumes the position of a creditor.

Alternative ETFs

Another type of ETF is one that allows you to redeem your shares for gold and is a closed-end mutual fund which will facilitate share trading by investors in exchange for 400-ounce gold bars. This option is provided by Sprott Physical Gold Trust (PHYS).

This can be a much more expensive way of investing since the trade may involve huge premiums or the net value of its assets may be discounted at any time. Should the investor desire to possess physical gold this may be done on the 15th of each month providing they have arranged for their own method of transportation and subsequent storage.

If you are interested in investing in mining stocks then you may want to consider yet a different type of ETF. Holdings of large-cap mining stocks can be acquired through Market Vectors Gold Miners (GDX). Market Vectors Junior (GDXJ) which involve development-stage minors may offer additional options to investors. Market caps of $150 million or greater are involved with both of these ETFS and trading over the last six months have been a minimum of 250,000 shares.

Depending on your level of risk aversion, in other words if you’re not adverse to a high level of risk you may consider Exchange Traded Notes(ETN). They are a form of debt instrument and they do track and index. Investors pay banks for a specified period of time and when maturity is reached investor is paying a return based on the performance of the commodity that the note is based on, such as gold futures. There are several popular ones including DB GOLD DOUBLE SHORT ETN(DZZ), DB Gold Short ETN (DGZ), DB Gold Double Long ETN(DGP) and UBS Bloomberg CMCI Gold ETN(UBG). There is flexibility in ETNs and although investors go long or short, without any principal protection your money may also be lost.

Related Posts

The Truth About Why Gold Prices Are Rising

All you have to do is turn on the news every day and you’ll quickly understand why investors are flocking to gold investments. How many times the last few years have you heard that the economy is the worst since the Great Depression. It’s not only one of the most popular ways that commentators love to describe the current economic climate, it’s also very true. Currently the United States is in… more

How to Buy Gold Bullion

During periods of challenging economic conditions gold bullion is often an investment that many people turn to. As economies run into difficulties gold generally increases in price. Generally a long-term investment, gold bullion may be handed down as inheritance through the generations. First it is important to understand exactly what gold bullion is. It is a term that refers to the investment quality of gold. Both coins and bars are different… more

How To Buy Gold Coins

Knowing how to diversify your investment portfolio by purchasing gold coins can be both an emotional and financially rewarding experience. Although the process can be complex and confusing, in the end it can be quite simple if you follow some basic proven guidelines. There is a wide variety of options available to you should you decide that gold coins are a desirable investment for you. Generally when people think about gold… more

How to Invest in Gold

Regardless of gold prices, and the fluctuations in the market, it can never really be said that there is a bad time to invest in gold. Cost averaging should always be your first consideration whenever you are looking to include gold in your investment portfolio. It is always a good idea to adopt a strategy that spreads your risk over time to better improve your chances of riding out the… more