Inflation Fears Continue To Push Gold Prices Higher

| by Michael Locklear

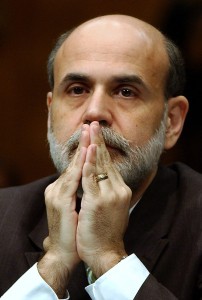

September 14, 2012 – Federal Reserve Chairman Ben Bernanke made his long-awaited announcement yesterday concerning his new round of monetary stimulus for the U. S. Economy. This time around his moves are even bolder than before. Quantitative Easing 3, involves a purchasing of mortgage debt to the tune of $40 billion per month for the foreseeable future. He also reiterated his commitment to maintain low interest rates. It is very clear that Bernanke has no fear of inflation.

The Fed has been taking extraordinary measures to shore up the economy for nearly 4 years now. There’ve been multiple policy measures including two previous announcements of quantitative easing. Interest rates have remained near zero since this time. Despite these measures and the theories of investors inflation has remained very low. There have been some minor price increases in food and energy, however not sufficient to cause any anxiety for the Fed.

In a statement made by the Fed, it is clear that they are comfortable with the current levels of inflation. In their statement they said, “Inflation has been subdued, although the prices of some key commodities have increased recently. Longer-term inflation expectations have remained stable.”

Despite nervous gold investors, their colleagues in the bond market do not seem to reflect their inflation related anxieties. The U.S. Treasury bond 10 year yield rate still remains very low, at around 1.74%.

Despite the lack of concern from the bond market and the Fed chairman, gold bugs continue to remain very anxious about inflation. Their view is that whenever a central banks print more money and pump it into the economy, rising inflation cannot be far behind. Although so far this has not been proven true. Nonetheless the benefits of gold has been enormous.

Gold continues to be seen as a major protection against the anticipated rising inflation and as a result of yesterday’s announcement gold shot up again today it was trading at $1776.60 per ounce. Gold prices rose more than 10% in August and are continuing to rise and are up nearly 4% so far this month.

Projections in gold prices will reach between $ 1800 and $2000 per ounce by year’s end does in fact appear to be quite realistic. The markets continue to be volatile, and it does seem that this volatility can be attributed more to the negative expectations of investors regarding the economy, more than the result of it, of actual increases in inflation as result of continued measures on the part of the Fed to stabilize and grow the U. S. Economy. The fears are there, however inflation continues to be absent. It does appear that the fear of something is more real then reality.