The Truth About Why Gold Prices Are Rising

| by Michael Locklear

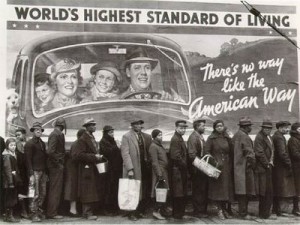

All you have to do is turn on the news every day and you’ll quickly understand why investors are flocking to gold investments. How many times the last few years have you heard that the economy is the worst since the Great Depression. It’s not only one of the most popular ways that commentators love to describe the current economic climate, it’s also very true.

All you have to do is turn on the news every day and you’ll quickly understand why investors are flocking to gold investments. How many times the last few years have you heard that the economy is the worst since the Great Depression. It’s not only one of the most popular ways that commentators love to describe the current economic climate, it’s also very true.

Currently the United States is in the deepest and most protracted economic contraction seen in more than 70 years. Not since the crash of 1929 has the United States economy had to deal with such devastating and seemingly intractable conditions. Very few jobs are being created, and the ones that are, aren’t normally considered to be evidence of a strong economy as they are in the service sector and various levels of government.

The official jobs numbers remain stagnant, as the unemployment rate is still hovering at or near 8% and more than 45 million Americans are on food stamps. Volatility still haunts the stock market and investors are extremely nervous about what the future will bring. Four years after the economic collapse of the real estate market requiring a nearly $1 trillion bailout of the investment banks, credit still remains tight, housing prices are still anemic, and housing foreclosures are setting records.

Thanks to a major government bailout General Motors has survived and has returned to the rank of the number one auto manufacturer in the world, but the real estate market is still in a coma. The United States Government is awash in a sea of debt, the United States Congress and the President of the United States are locked in mortal combat over the need for new taxes, the need for additional stimulus, and what steps to take to bring about real recovery. Despite three quantitative easing measures by the Federal Reserve, the unemployment rate remains entrenched, and even though we are seeing some minor forward motion, the U. S. Economy still remains extremely lethargic. In addition all of this extreme debt is severely damaging the economy of most states and large cities.

The stock market which has always been governed by fear, emotion and greed, now has to deal with the added problem of extremely nervous investors who are using every reason possible to flee from risk in search of safe havens. The fears of inflation have investors nervous all over the world. Governmental debt crises have spread from Iceland to Greece, Ireland, Spain, and Italy. Many feel that it will engulf the entire world. Weakening currencies in both the United States and the European Union and weakening demand and output, as well as contractions in the Chinese economy, have investors large and small, both private and institutional, shifting major attention toward gold. Some believe that speculators are right in that the currently dominate U. S. Dollar is in severe jeopardy. Some financial analysts believe that the US stock market, which is very high at this time, is actually top-heavy and heading for a massive downward correction.

U. S. Interest rates, which have remained at virtually zero due to efforts by the Federal Reserve, and are expected to remain so into 2015, have created one of the greatest opportunities in history for the gold market to explode. With money so cheap, there is never been a better time to buy gold. Due to excessive demand from investors highly desirable bullion products are experiencing fulfillment difficulties. The daily spot price for gold is not pushed up due to industrial demand but instead as a result of its universal desirability as a safe haven against inflation and other economic storms. Continuing currency devaluations will only serve to increase the world’s demand for more gold.

Recently an entirely new group of major investors have begun seeking gold as a shelter. Recently two famous billionaires in the persons of George Soros and John Paulson have moved their money into gold as well. Furthermore they are joined by the central banks of numerous countries who are also in the process of stockpiling large gold reserves. This is a historic move on the part of the central banks since they have not adopted this practice to a large degree since 1964. The previously largest sellers of gold are now becoming massive buyers of gold. The central banks of China, India, and Russia are adding significant fuel to the gold market. The Peoples Bank of China and the Chinese government are not only stockpiling the world’s largest accumulation of gold but is also encouraging Chinese citizens to purchase and invest in gold as well. The fact that China is moving away from the dollar and towards gold is really quite disturbing to investors all over the world.

Fears about inflation, and the likelihood of inflation itself, are fueled by the current practices in the future actions anticipated by major central banks around the world. Interest rates at near zero, weakening currencies (the dollar in particular), an enormous cash infusions through monetary easing, traditionally bring about an inflationary environment. As investor fears increase, they move away from what they consider to be more risky forms of investment, including the stock market, towards what is viewed to be a safer and more stable place to invest their money. It is for this reason that U. S. Treasury Bonds and gold are still considered relatively safe and investors are moving massive amounts of money into these holdings. Because of these and other concerns market analysts and experts and investors around the world believe that the current record high price of more than $1700 per ounce for gold is not the ceiling, but the floor. Currently there are projections that the spot price of gold will reach $2000 or even more before the end of 2012.

The U. S. Dollar, as the global default currency, has enjoyed a lot of popularity recently. Currently the dollar continues to weaken. Despite its continuing devaluation, the US dollar continues to be very popular in the investment markets. Despite two previously massive infusions of money into the system by the Federal Reserve and years of a stagnant economy, the dollar store remains relatively strong. Nonetheless, it still remains clear that the dollar’s continued weakness can be contributed to previous enormous monetary stimulus and the anticipation that the new round will continue the current trend. Fortunately the dollar is still popular with foreign investors both private and institutional and this may continue for some time into the future, however just now there does appear to be a move away from the dollar toward gold as some major investors are using dollars to move into gold.

As we move forward, investors are still nervous as some anticipated inflationary impact on the most recently announced stimulus program by the European Central Bank to buy up more of Spain and Italy’s debt. The world is still watching to see what will happen in the Greek economy and how China will manage its instabilities. Further stagnation in the labor market and in other arenas within the U. S. Economy has experts predicting that this new round of quantitative easing by U. S. Federal Reserve will have the dollar continue to weaken and more investors will move away from the dollar toward gold pushing the price ever skyward.

Related Posts

Gold Drops On New Economic Numbers

October 15, 2012 - Gold prices fell to their lowest level in two months but still remain near an 11 month high. Investors are still watching to see what Spain’s decision will be concerning a bailout. Spain’s credit rating was lowered on Wednesday by Standard & Poor’s to near junk level, while economic ministers report that a future request for a bailout from the Eurozone will not make any political resistance. Gold bullion… more

Gold Cautious as Dollar Rises

October 9, 2012 - Continued concerns over the euro zone’s economic stability push the euro lower as the dollar strengthened. In a meeting on Monday of the euro zone finance ministers they decided that Spain would not need a bailout at this time due to the fact that they believed that that country was able to stabilize its own capital markets without further assistance from the European Central Bank at… more

Gold Prices Continue to Rise On Fed Expectations

September 11, 2012 - As investors are waiting and anxiously anticipating the outcome of this week’s meeting of the Federal Open Market Committee (FOMC), which is responsible for policy-setting and the Federal Reserve, to see if the Fed will institute a new round of monetary policy; the market is still fired up about QE 3. The spot price for gold rose again today to $1734.70 per ounce. Still encouraged by the… more